Author: Oguz Genc

The two self-proclaimed properties to the conceptual framework of a DAO as evident as it gets. They are ‘decentralized’ and ‘autonomous.’

After many DAOs have been formed during the past few years, recent studies question whether these fundamental qualities meet expectations. This piece focuses on the ‘decentralization’ aspect of DAOs and how recent research interprets this characteristic.

Some of the literature reviewed in the previous piece displays the controversial debate surrounding the evaluation standards for decentralization. We cited Hassan and De Flippi (2021) for their argument on the lack of consensus on what decentralization or autonomy truly means. We have also seen from The DAO hack that a base layer smart contract network could be forked in extreme cases, which violates the claim of a deterministic immutability. In the early adoption phases of a smart contract networks, ‘decentralization’ is advertised as an innate property of the network; nevertheless, with all the hype around decentralization, such claims eventually get a reality check.

In this piece, we look into some academic and non-academic research that examines the proposition of decentralization within the context of DAOs.

Rikken et al. (2021) refer to the discussion on the word ‘decentralized’ at a semantic level to understand whether it refers to an application that uses a blockchain while stating that smart contract usage is no precondition for the definition of DAOs. This approach is too fundamental since it implies that Bitcoin may also be categorized as a DAO. As discussed in the previous piece, Ethereum is now the leading platform for building DAOs as in the definition of our research. At the same time, we accept that smart contract usage is a natural trait of such organizations as all competitors of Ethereum intersect at the most basic novelty of offering smart contract services.

Another critical point is the distinction between decentralization and autonomy in an operational sense. Decentralization refers to the independence of central control, while autonomy refers to the self-execution of all executive decisions of a DAO.

For this reason, Rikken et al. (2021) claim that recent technical features implemented into so-called DAOs challenge the ‘autonomy’ of DAOs. Off-chain initiatives that separate the decision-making from the execution of the decisions make DAOs less autonomous and run the risk of becoming centralized because the follow-up actions have to be triggered manually and are no longer automatically executed directly based on the decision outcome. These initiatives were identified as decentralized organizations (DOs) instead of DAOs.

This nuance clarifies how autonomy and decentralization are related rather than defining them as distinct attributes. Hence, the hypothesis could be refined by saying that without genuine autonomy, decentralization is not possible. However, we still face the questions; what is decentralization, and how is it achieved?

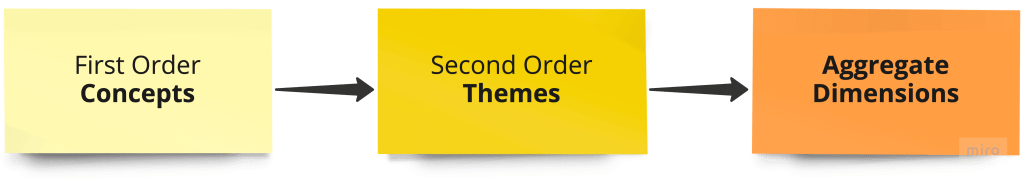

Therefore a systematic approach to defining ‘decentralization’ for DAOs and to what degrees this can be defined becomes a fundamental research question, to which Axelsen et al. (2022) specifically attend. The authors define a degree of ‘sufficient decentralization’ based on a methodology that samples data through first-order concepts that build up to second-order themes, eventually building up the aggregate dimensions as shown in Figure 1, while Figure 2 details the latter two. Regulatory advisory was sought beforehand to meet the minimal compliance expectations, while the resulting aggregate dimensions are later put through rigorous analysis to evaluate the degree of decentralization to guide regulatory frameworks that are either in their nascent phases or upcoming in most parts of the world.

This data structure for first order concepts ultimately cover many possible aspects of DAO decentralization from legal, technical, and supervisory approaches while maintaining the autonomy characteristics within the framework. As it turns out, the details are too refined to summarize in this piece. We recommend reading the paper in case readers are extensively interested in how decentralization can be evaluated from a structural framework. Yet, below is a random example:

| First order concept: “There should be evidence of distributed token holdings” |

| Second order theme: Concentration of voting power |

| Aggregate Dimension: Token Weighted Voting |

Another example for a 1st order concept is “I would expect diversified token holders through distribution methods such as pre-sales token distributions or other distributions” which relate to the same aggregate dimension, yet is affiliated to the second order theme of token distribution at launch.

Although both concepts relate to the concentration of token distribution in theory, which relates to the centralization dimension of token-weighted voting, the distribution phases under the scope are different. The authors introduce many other concepts to approach DAO decentralization from various angles.

The authors continue by presenting their framework to analyze the data structure. They begin by taxonomizing three groups of agents in a DAO network. From top to bottom, the degree of pseudonymity increases while the history of participation shows higher levels of automation in the public wallet addresses, which indicates decreasing levels of vested interest. The definitions for such agents are helpful to understand the centralization analysis regarding the voting power based on token ownership.

- Verifiably Independent Agent

- Presumably Independent Agent

- Unidentifiable Agent

An iterative process and pattern analysis are employed by interviewing a diverse group of experienced industry participants to improve the conceptual data structure. Eventually, a questionnaire framework is formed. While some assessments are quantitative, others are qualitative.

Based on the final framework, the DeFi powerhouse Compound DAO is evaluated according to the framework as a sample evaluation, which shows mixed results yet indicates sufficient decentralization as the network matures, which of course is the outcome within the standards of this framework.

Can decentralization escape subjectivism?

Unfortunately, the evaluation of decentralization can be heavily subjective. Especially in the early phases of any DAO, the founding team will keep the majority of the tokens to have a controlling vote percentage to implement the vision for the product, posing decentralization as a utopian goal to be achieved in the future. However, there is no precedent where gradual decentralization has occurred for a DAO over time. While particular aggregate dimensions mentioned in this article may hypothetically shift toward decentralization, there is not enough research on how DAO decentralization can be evaluated.

Looking at ex-post evidence from more recent DAO votes, we may be able to gain a better understanding of how ‘decentralization’ is taking shape in practice.

The most recent example occurred with the long-awaited token distribution of the popular Ethereum Layer 2 solution Arbitrum DAO held a vote for using about $1 billion worth of its tokens for “Special Grants.” Although the community voted against the proposal, it was revealed that some tokens were already sold by the foundation, leading to an unfathomable defense by the Arbitrum team posted on their forum to communicate that the vote was only to ratify the decision that had already been made by the team.

The backlash by the community was fierce. See the rampant response of Chris Blec, who represents himself as an ardent advocate of decentralization. There are many crypto community members who have expressed similar discontent. Indeed, such events impact future user adaption for DAOs negatively. However, there are other stories that are significant enough to understand the various struggles behind the decentralized governance efforts.

Another prominent example of DAO centralization occurred as a token voting centralization between some of the most renowned actors in the space, namely the famous crypto venture capital fund A16Z and Uniswap DAO, the largest decentralized exchange in the DeFi space. The vote took place to decide the official cross-chain governance for Uniswap, which is a significant decision toward expanding the exchange network to other smart contract platforms. Although A16Z reportedly controls the highest voting power in Uniswap, their tokens only amount to 1.5% of the total sum. The fund abruptly voted against using Wormhole, a competitor of its investment LayerZero, which they favored as the cross-chain governance partner. This decision was unexpected, yet it is essential to note that the total amount of votes was low enough for A16Z to singlehandedly attempt to change the vote result, which they shortly achieved before more votes were casted to reverse the final result. Thus, rather than an issue of voting power centralization, this vote surfaced the need for more community contribution to votes, even for critical decisions.

Another crucial point to remember with this vote is that the voting took place at Tally, a third-party service for DAO votes. Unless the vote takes place on-chain, the decision is not executed automatically, which Rikken et al. (2021) refer to as a violation of the definition of DAO, as we have mentioned in our previous article. Nevertheless, the Uniswap DAO vote was on-chain, preserving its status based on the authors’ definition.

Finally, we look at another community piece that focuses on the “Howey test” to define ‘sufficient decentralization’ within the U.S. regulatory framework. The author argues that the holders of the governance tokens should do so with the expectation of taking profit through the uncoordinated efforts of a broad range of people, which in itself, as an argument, also indicates a high level of subjectivity. There is no answer to what is the minimum sufficient number of people to satisfy the definition for a “broad” range of people. That may be up to regulators to define in the future. Nevertheless, the author uses the Gini coefficient to test the centralization of voting power distribution for renowned DAOs, including Compound and Uniswap, which are mentioned in this article. The results show a very high level of centralization. The author concludes by highlighting the hazards of off-chain governance. The occasional anonymity of the core teams is also highlighted as a critical fault line for certain DAOs that depend on social consensus. Unfortunately, the number of such failed projects is almost too many to count, resulting in diminishing trust for anonymous builders in the decentralized software community.

Conclusion: A more deterministic approach to evaluate DAO decentralization

Notwithstanding all aforementioned research, decentralization research on DAOs requires a more comprehensive framework regarding a systematic analysis that includes some other components constituting a DAO. Instead, to put it in question, how can DAO decentralization be evaluated within a framework that excludes its underlying constituents? Therefore, a minimally comprehensive framework for an analysis of decentralization should contain the following subjects to achieve end-to-end scrutiny for the claims on decentralization:

- Web2 layer

- Protocol layer

- Automation layer

- Token layer

- Regulation layer

Axelsen et al. (2022) focus on the subjects relevant to numbers 4 and 5 but perhaps chose to exclude the first two as they constitute the underlying infrastructure of DAOs, over which builders and business developers have little control. They do not address these aspects.

In the case of number 1, the relevant web services are almost entirely dominated by cloud infrastructure and content delivery networks that are highly centralized. Meanwhile, it is only possible to evaluate the decentralization of DAOs with their foundational network components, the Layer 1 smart-contract service such as Ethereum. More recently, the scaling networks of Ethereum have shown signs of adoption. Therefore Layer 2 networks on the Ethereum Network need to be incorporated into such a systemic analysis, at least as a disclaimer to the audience.

Lastly, the automation layer needs to be dissected as deeply as possible to understand the extent of the possibilities regarding human intervention. Could the team change the code without a vote if they wanted to do so? Is the DAO vault controlled by a multi-sig wallet, which is solely controlled by the team? Who are the team members? All these questions are crucial as these networks develop to maturity, meaning the centralized control could be imposed at a stage. Just because a network is permissionless, it does not mean that the code or funds are not ultimately controlled by a small group of people. Therefore, immutability is not a prerequisite for permissionless networks. In that case, the approach to the systematization of how decentralization can be evaluated requires a fundamental pivot. The most plausible option would be evaluating decentralization from the perspective of what makes a project exempt from regulatory enforcement.

These discussions lead to another discussion, perhaps a more existential one for DAOs. Although builders have limited options about the tools to use for product development regarding Web2 or protocol layers, they can design services that may limit human involvement in their products to a minimum, which may arguably pose a deterministic alternative against DAOs. We hope to cover this topic in the following article.

Bibliography

Axelsen, Henrik, Johannes Rude Jensen, Department of Computer Science, University of Copenhagen, Universitetsparken 5, DK-2100 Copenhagen, Denmark, Omri Ross, and Department of Computer Science, University of Copenhagen, Universitetsparken 5, DK-2100 Copenhagen, Denmark. 2022. “When Is a DAO Decentralized?” Complex Systems Informatics and Modeling Quarterly, no. 31 (July): 51–75. https://doi.org/10.7250/csimq.2022-31.04.

Hassan, Samer, and Primavera De Filippi. 2021. “Decentralized Autonomous Organization.” Internet Policy Review 10 (2). https://doi.org/10.14763/2021.2.1556.

Rikken, Olivier, Marijn Janssen, and Zenlin Kwee. 2021. “The Ins and Outs of Decentralized Autonomous Organizations (Daos).” SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3989559.

Disclaimer: All generated content is for research purposes only. The author does not and will not provide any investment advice.